The Federal Reserve is on the brink of finally cutting interest rates. Now is a fantastic opportunity to get ahead of the curve and reassess your financial strategy.

We’ve compiled some strategies which you should consider before interest rate cuts go into effect.

#1: Make Sure Your Money is Going into the Correct Savings Account

The average return on a traditional savings account is 0.46%. In some cases, a high-yield savings account could net you a return of over 5% now, which is above the inflation rate.

You need to be aware that the average return on a high-yield savings account will almost certainly slide after the Fed starts cutting. There are a couple of ways to handle this.

You could just leave it alone and earn a lesser amount of interest on your savings account funds. Or, if you don’t want to risk losing your current high interest rate, you could open a certificate of deposit (CD). This account will allow you to lock in your current interest rate. This strategy has a drawback, however: You cannot access your funds during the CD term.

Don’t waste this opportunity to improve and/or lock in your savings rates.

# 2: Eliminate Your Credit Card Debt.

Now is as good a time as any to pay off those credit card balances. Once you do this, you’re instantly improving your credit score. Credit card balances are typically one of the biggest culprits for high-rate debt. Interest rates on many credit cards are over 20%, according to the Federal Reserve.

If you qualify, consolidate your credit card debt for a zero-rate balance transfer card. This will allow for a maximum of 21 months’ worth of 0% interest. This is an easy way to reduce your balance and improve your credit score.

# 3 Plan for Large Purchases

A reduction in interest rates signifies a decrease in inflation. This implies that if you’re considering a major purchase, such as a new car or a new home, soon it will be a relatively good time to do so.

But before you do anything, make sure you do your research on the rates. The average rate for a 30-year, fixed-rate mortgage is now just under 6.5%, according to FRED Economic Data. Keep an eye on this.

Being patient and paying attention to rates is the smartest approach.

# 4: Review Your Investment Strategy

Historically, interest rate cuts have usually been a great opportunity to start investing in different asset classes.

You shouldn’t make any dramatic moves immediately, but if you wanted to make some adjustments, consider rebalancing your portfolio to include sectors such as consumer discretionary, real estate, and tech. These sectors typically outperform when interest rates fall. Usually, these sectors really benefit when borrowing costs decrease.

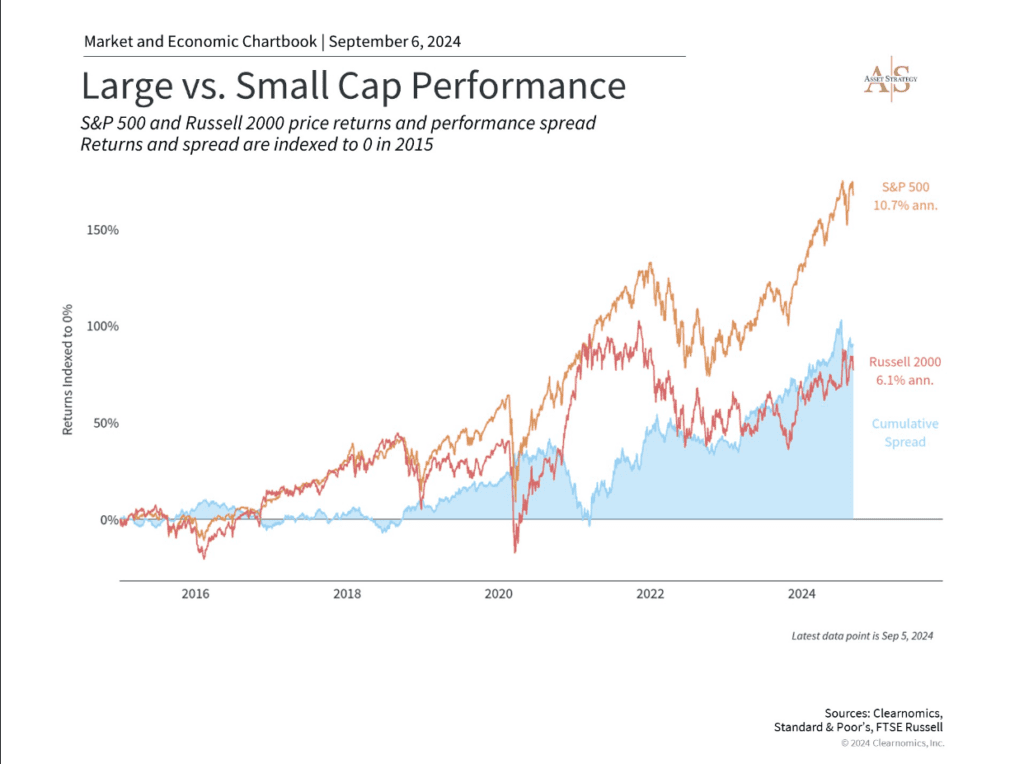

Small-cap stocks are also a sector that typically performs well in a lower interest-rate environment.

Large caps have performed extremely well over the past several years due to hot technology and AI stocks. However, diversification across sizes and styles remains crucial. Small caps can also perform well when rates are low and the economy is strong.

This chart shows the price return performance of the S&P 500 representing large cap stocks, the Russell 2000 representing small cap stocks, and the spread between the two. The spread represents a compounded return and is not simply the arithmetic difference between the two indices at any given point in time. All series are indexed to 0 on the start date.

Conclusion

It is important to be proactive with your finances before interest rates are cut. By making these strategic moves now, you are positioning yourself to benefit when the September and subsequent fall interest rate cuts comes to fruition. It is also a wise decision to seek the help of a financial advisor who can guide you sort through your specific situation.